Whether you are looking for money to help pay for your child’s tuition or looking to finance a major home improvement project, one of the ways you can get access to a significant source of money is with your home’s equity.

In fact, for some homeowners, the amount of money they can get from home equity can be more than other loans they might find. Since these loans can come with much lower interest rates and better terms than personal loans and credit cards, it is one of the most attractive options out there.

That said, if you are unfamiliar with home equity loans, let us get into details about what they are and how they work.

Home Equity Loans

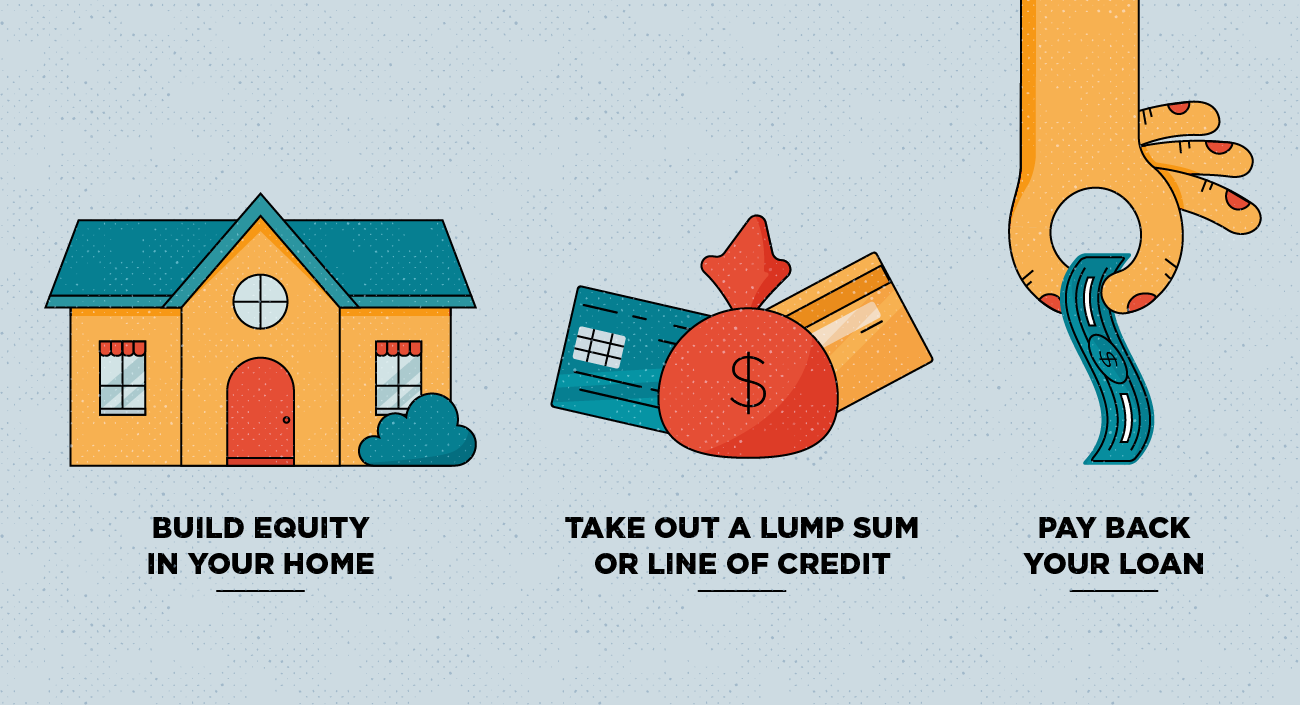

A home equity loan is a type of loan that uses your home as collateral to borrow money. The value of the loan depends on the current value of the property minus the mortgage balance due. This difference is called your home’s equity, and it represents the amount that you can borrow.

When you take out a home equity loan, you get the entire sum up front, which you slowly pay off with monthly payments. These loans can have a term period of anywhere between five to thirty years, depending on the agreement. The interest rate is usually fixed.

There is another type of home equity loan known as HELOC (home equity line of credit). It works similarly to a credit card in that it will feature a credit limit (equivalent to the home’s value) that can be reset within the draw period. Once the draw period is over, you cannot take out any more money, and that is when your repayments begin. With HELOC, you will get variable interest rates, too.

The Money

How much money can you take out of a home equity loan? In most cases, the maximum will not be more than the current value of the home.

That said, most lenders will have a loan-to-value (LTV) of between 75 to 90 percent. This means that you can borrow money no higher than the percentage that they set.

For instance, say you find a lender with a 75 percent LTV limit. If you are looking to borrow $100,000 but still have a mortgage balance of $200,000 on a $500,000 home, you will add the $100,000 to the mortgage balance and come up with $300,000. From there, you will divide this figure by the total value of your home, getting 0.6. Multiply that by 100, and you get 60 percent.

Since 60 percent is lower than the lender’s LTV limit, you will be able to borrow the $100,000 that you needed.

Conclusion

As you can see, you can use your home to your advantage by getting the money you need to cover for any expensive venture you might have. However, remember to be responsible! Just because you have money to borrow does not mean you should.

Before you head out to any lender, be sure that they are reputable and that what they have to offer is something you can agree to and afford. Some lenders out there can take advantage of your situation if you’re not careful.

Before you opt for any loan, read the fine prints carefully and do research about the lender. That way, you can find a lender you can trust and give you the best deal possible.

Are you in need of help to find the best home equity loan in Buffalo? Good Neighbors Credit Union is here to lend an expert hand. Whether you are looking to apply for loans or manage your finances, we have the resources you need to get it done. Reach out to us today!