Home renovation projects hardly come cheap. Whether you’re gutting your entire kitchen, making space for an additional room, or simply opting for a brand-new paint job, it can be tempting to simply charge every expense to your credit card. However, a home equity loan may be a more ideal way to fund your redecoration project. Here’s how you can take advantage of this unique opportunity.

What is a Home Equity Loan?

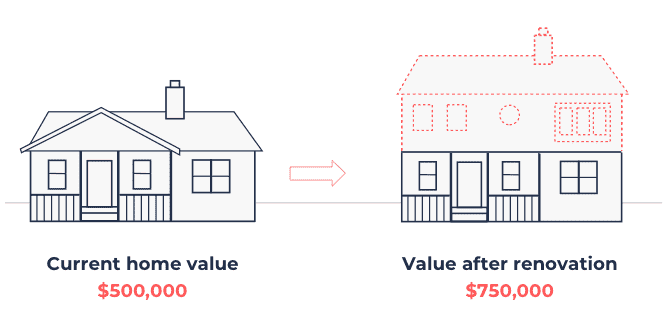

Before studying the how’s and whys of a home equity loan, let’s first define it. Secured by your home’s value, your property serves as collateral for guaranteeing the funds borrowed. When borrowers apply for a home equity loan, they receive a fixed amount of cash in a single lump sum.

The amount you qualify for is determined by the home’s loan-to-value (LTV) ratio, the payment term, your monthly income, and credit history. Most HLEs will have fixed interest rates, fixed terms, and fixed monthly payments.

The Benefits of a Home Equity Loan

The greatest advantage of applying for a home equity loan with a bank or credit union is its fixed interest rate. Because borrowers are aware of how much they need to pay for the entirety of the loan, budgeting for payments is far easier. Unlike those who apply for adjustable loans, borrowers aren’t subject to the fluctuation of rising interest rates. Not to mention, the interest paid on a HEL is 100% tax-deductible.

Unlike other loans, which require payments toward the loan’s interest within the first five years, HEL is consistent in its repayment plan throughout its lifetime. In some cases, applicants can borrow larger sums of money but may incur a penalty through early repayment.

The Cons of a Home Equity Loan

As with any loan, home equity loans serve a specific purpose that won’t always suit a borrower’s needs. Before applying for a HEL to finance your home improvement project, note that they often come with several extra fees that you’ll need to prepare for before finalizing your loan.

Additionally, by receiving the loan in a single lump sum, borrowers have less wriggle room when it comes to making any adjustments to the intended renovation. Thus, those taking out a HEL should know exactly what type of work they want to be done to the property. If you have only a vague idea of your desired home makeover, you may end up borrowing an insufficient amount of money.

Lastly, borrowers are obligated to make fixed monthly payments regardless of their financial standing at the time. By defaulting on the loan, you could potentially lose your home in the process. Hence, borrowers should make it a point to prepare for these monthly fees in advance by increasing their credit limits and setting aside larger amounts of savings.

Conclusion

When seeking a home equity loan to finance your remodeling project, make sure you can meet the upfront and monthly fees they come with in the first place. With any loan, consider what makes the most sense for your current finances.

In need of a home equity loan in Buffalo NY or access to stress-free banking alternatives? Apply for one with Good Neighbors Credit Union! Upon closing your loan, you can pursue your summer plans with a staycation prize until August 21, 2020! No need to bid your holiday goodbye—apply for a loan today and you can still enjoy an at-home mini-break.