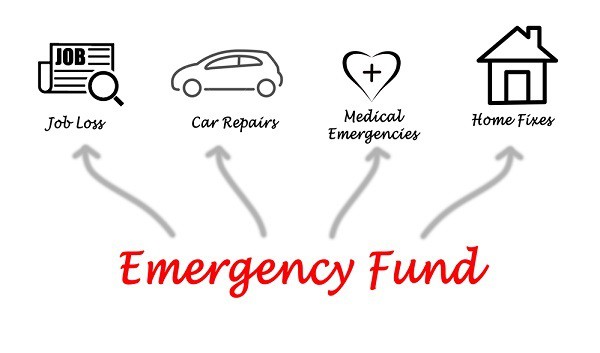

Having an emergency fund in your back pocket is always a good idea. Whether you are planning on setting aside savings in case of a medical emergency or for household concerns, there is no reason you shouldn’t create an emergency fund.

If you have already experienced losing income or not being financially prepared for an accident, it helps to compile an emergency fund so that it doesn’t happen again. It is a good financial backup plan.

It is important to note that an emergency fund is different from your savings. While you may have specific savings goals such as wanting to buy a house in the future, or maybe even short-term goals such as travels, it should be separate from your emergency fund.

Here are some of the reasons you may want to start one.

1. Will Help in Case of Unemployment

Having an emergency fund will come in handy in case of unforeseen employment. You will have money to spend even when you lose a steady stream of income. During the COVID-19 pandemic, around 28.5 million jobs were lost. Compared to the Great Recession of 2008, it is significantly higher.

Should you find yourself in a situation like this, it can be hard to stay on top of bills payment, medical finances, and other important payments. With an emergency fund, you can at least cover the basics, and it should save you some time until you can find another source of income.

2. Needed to Fix Major Household Repairs

A number of factors can affect your home: the climate, extreme weather, or even things such as molds. You never know when you will need major household repairs. Even with a steady income, big repairs are tough on the wallet.

Things such as fixing your A/C unit or repairing your roof can cost over $500. That said, big, sudden expenditures like this can take you aback. But having an emergency fund at the ready can keep your worries at bay.

3. Crucial for Medical Emergencies

Given the current situation, medical emergencies are a more sensitive case than ever. If you don’t seek the proper treatment as soon as possible, who knows what could happen. Plus, medical bills aren’t cheap. A trip to the emergency could be enough to make a dent in your savings.

It’s always a good idea to keep an emergency fund not just for yourself but for your family as well. Should anyone need care for a medical emergency, you won’t have to worry.

4. Saving up for the Future

Emergency funds are simply great for saving up for the future. No matter what life throws at you, at least you know that you are covered, even in some small way. We recommend that you have an emergency fund that is three times your monthly expenses.

Don’t be afraid to start small. Soon enough, you’ll realize that you’ve accumulated just enough to help in the future.

Conclusion

Setting up an emergency fund is important for anyone who is receiving active income. The earlier you start saving up, the more funds you will have to use in the future, should you need to.

Create a savings account with Good Neighbors Credit Union. We seek to help you build a financial foundation as a stress-free and accessible banking alternative. We offer secure solutions to your financial concerns and empower members to manage their finances well. Consult with us today!