Securing your hard-earned money is crucial in achieving your goal. When storing your everyday cash, you can choose between a bank or credit union. To understand the differences between these two types of financial institutions and determine which one is right for you, consider this article as your guide.

What Are the Differences between Banks and Credit Unions?

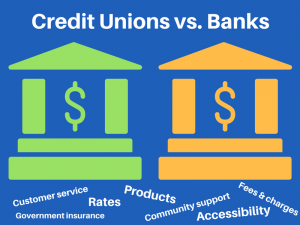

The main difference between banks and credit unions is their profit status. Banks are for-profit enterprises, which means they are privately owned or publicly traded, while credit unions are not-for-profit institutions.

Banks are focus on making a profit instead of concentrating on the account holders’ needs. Because of this, they usually charge more fees and at higher rates than credit unions do.

Credit unions aim to serve a community based on their employer, location, membership in another organization, and other factors. They offer financial products on the most favorable terms. For instance, they offer small dividends and discounted loan rates to many members, unlike banks that provide accounts to customers and large dividends to a small group of owners.

What Should I Ask Before Choosing?

Whether you prefer the bank or credit union, consider what kind of fees they charge and how much they are. Check with the financial institution about monthly maintenance and overdraft fees. You also have to determine how many local branches and ATMs they have near your area, especially if you prefer in-person service or need to withdraw or deposit cash from time to time. In addition, you should learn more about the interest rates they offer on the checking account or savings account you are considering from them.

How Do I Make a Choice?

To determine the right option for you, identify what matters most to you. Come up with a list of account and customer service features and discover how they can work best for your situation. For instance, if excellent customer service, higher interest rates on deposits, and lower rates on loans matter to you, consider choosing a credit union. In contrast, you should opt for a bank if you want to take advantage of the convenience offered by new technology and tools and more branches across the country or in the region.

You also have to find your top contenders by knowing the banks and credit unions that offer the best account features to address your need. Finally, narrow the list down based on your top criteria. Consider also if you can take advantage of some of their features in the future or have negative aspects that can change your mind over time about which option to choose. As soon as you make an informed decision and ensure that your choice suits your needs, apply for an account.

Conclusion

Choosing between credit unions and banks plays a vital role in making the right choice for your hard-earned money. While both financial institutions offer several same products and services, they still address different needs. When choosing, remember the information discussed in this guide. You can also explore the best tools and resources available to manage your finances better. Let us guide you toward the path of financial freedom with loans, online banking, and our other services. At Good Neighbors Credit Union, we offer an accessible and stress-free banking alternative for clients in Buffalo, New York. Become a member today!